How to save to live alone

Being independent of the family home and living in a home is a logical aspiration of any young person, although sometimes the lack of funds prevents it from being carried out. However, sometimes it is not so complicated if expenses are adjusted and money is used rationally. Keep reading if you want to know how to save to live alone .

Steps to follow:one

First of all, make a list of all your expenses in a normal month . If you do not have the tickets or the receipts, try to make an estimate as adjusted and realistic as possible. And if you have to round, try to do it up and not down. If you can, assign a limit amount for each concept and try not to spend more each month than what is assigned to each one. If you can not make an expense in that month and it is not urgent, wait until the next.

two

Order the concepts that make you spend more money per month or think you can do it, if you have not taken the step yet. Choose those that are absolutely essential and decide if with your current salary you can afford to live independently. For example, if the mortgage or rent expenses are excessive, you can consider sharing a flat, and in this way you also share other fixed expenses such as electricity, water, community, Internet ...

3

How much do you usually spend per month on food? Maybe you can save more than you think if you change the brands of some products. Instead of precooked food, more comfortable to prepare but more expensive and often less healthy, you can switch to a more traditional diet, in which there is more vegetables and less meat. You can devote for example one day a week to cook several dishes such as stews, sauces and stews that you can store in the freezer and ration for a long time, then heating in the microwave.

4

The electricity bill increases every time, so you have to control expenses very well. If the thermos is electric, make your showers shorter; turn off the light each time you leave a room; do not have the TV set in the background if you are not paying attention; turn off the router when you leave home if you are not using the Internet; use energy saving light bulbs; disconnect the charger from the mobile or tablet when it has finished loading ... There are many small gestures that do not cost to incorporate into the daily routine and make you end up saving a good money. Also you can see here some other tips to save on the receipt of electricity.

5

Ration your leisure . Sometimes a weekend ends costing an eye of the face, and we do not realize until we do a count the next day. You can alternate exits to entertainment venues and events on the street with meetings with friends at home. You can watch a movie, organize a dinner, play the game console or table games, and much more.

6

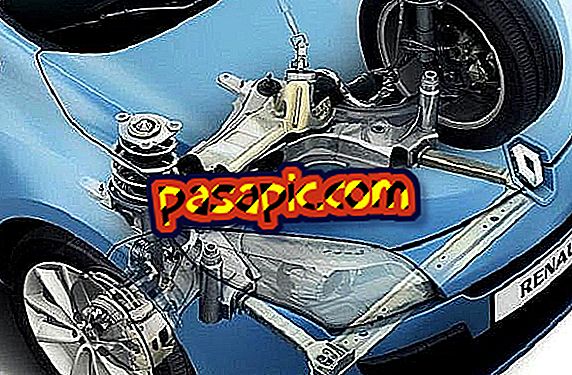

Choose your means of transport well . Do you really need a car? Maintaining a private vehicle has many associated expenses, apart from gasoline: taxes, repairs, insurance, spare parts, etc. If you live in a city with a good public transport network, you can go almost anywhere by bus, commuter train or metro, or if you can afford it, walking or cycling (much cheaper and better for your health). If you use public transport, be well informed of the different bonuses and discounts that you can benefit from.

7

Check your phone rates . Do you have really hired the cheapest company? Do you use your phone as much as to pay that bill each month? Rate if it is worth changing the company or rate, depending on your needs. You can find useful the tricks that we tell you in How to save on the phone bill.

8

Control compulsive purchases If you really did not have thought to buy something and you do not need it, stop before removing your wallet. If you see a product with a large discount in a shop window it can be very attractive, but if you do not buy it, you are actually getting a hundred percent discount.

9

Make a count of all the commissions you pay. Do you need to keep a credit card with a high commission? If your bank charges more commissions than you would like, assess other financial options. If you are charged for concepts such as making money transfers over the Internet, you can do them in person at their offices to save that money.